Take home pay calculator hourly rate

If you earn 27000 a year then after your taxes and national insurance you will take home 22202 a year or 1850 per month as a net salary. What is the impact of increasing my 401k contribution.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours.

. Our G-Wizard Estimator software has a Machine Hourly Rate Calculator. This is a net difference of 051 an hour compared to before the NHS. Switch to salary calculator.

Convert my salary to an equivalent hourly wage. Divide your biweekly income by how many hours you typically work in a your typical pay period. Only the highest earners are subject to this percentage.

Wondering what hourly rate you earn on a 50k annual salary in Ontario. This is a net difference of 052 an hour compared to before the NHS payrise. Federal income tax is usually the largest tax deduction from gross pay on a paycheck.

If you work 50 weeks a year are paid ever other week then multiply those biweekly pay periods by 25 to calculate the associated annual income. CNC Machine Hourly Rate Calculator. Just enter your annual pre-tax salary.

Heres what the CNC Machine Hourly Rate Calculator looks like. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Need help calculating paychecks.

Hourly Paycheck and Payroll Calculator. Federal income tax rates range from 10 up to a top. For many finding their hourly pay rate is as simple as looking at a recent pay stub.

For example if you. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

A Band 5 1034. This Arkansas hourly paycheck calculator is perfect for those who are paid on an hourly basis. How will payroll adjustments affect my take-home pay.

Average hourly rate. In 2022 the federal income tax rate tops out at 37. Woolworths employees with the job title Order Selector make the most with an average hourly rate of AU3172 while.

The Home Depot Inc. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

On a 60k salary or a 40k salary. What is my hourly rate if my annual salary is. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

27000 Salary Take Home Pay. However if youre a salaried employee or are self-employed calculating your hourly wage 1 X Research source takes a few steps. If you already know your gross pay you can enter it directly into the Gross pay entry field.

It assumes 40 hours worked per week and 20 unpaid days off per year for vacation and holidays. A lot of shops use the notion of hourly rate on machines to help with job cost estimation and quotation but theres not a lot of information available about how to calculate a good hourly rate to use. It is levied by the Internal Service Revenue IRS in order to raise revenue for the US.

Switch to Arkansas salary calculator. This tool will estimate both your take-home pay and income taxes paid per year month and day. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If you have 2 weeks off you would take off 1 biweekly pay period. Should I exercise my in-the-money stock options. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Your gross pay will be automatically computed as you key in your entries. Hourly pay at Woolworths ranges from an average of AU1592 to AU2649 an hour. Mining quarrying and.

What may my 401k be worth. A Band 5 1075. Convert my hourly wage to an equivalent annual salary.

Employees with the job title Field Service Technician make the most with an average hourly rate of 2051 while employees with the title Paint Associate make the least with an. Based on a 40 hours work-week your hourly rate will be 1298 with your. What is the future value of my employee stock options.

Forestry logging and support. The NHS Band 4 page details the total amount of Tax NI and Pension that is deducted from gross pay and what percentage is left as take home pay. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

To calculate your hourly rate from your annual salary please refer to the chart below. You can quickly calculate your net salary or take-home pay using the calculator above.

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Hourly To Salary Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Hourly To Salary What Is My Annual Income

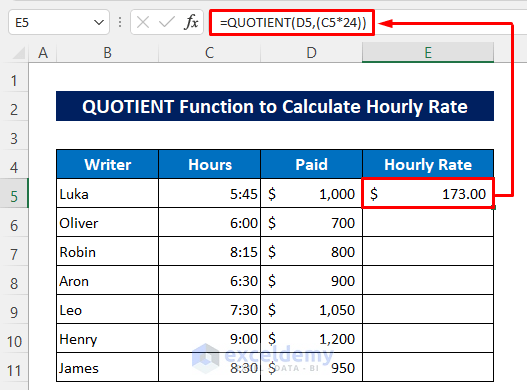

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Hourly Rate Calculator

Hourly Rate Calculator Plan Projections Rate Calculator Saving Money

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly Rate Calculator

Hourly Rate Calculator The Filmmaker S Production Bible

Hourly To Salary Calculator Convert Your Wages Indeed Com

Hourly Rate Calculator

Salary To Hourly Calculator

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay